tax exempt resale certificate ohio

The Virginia state sales tax rate is 53 and the average VA sales tax after local surtaxes is 563. In order for the supplier to allow the tax-exempt purchase the seller needs proof the buyer intends to resell the product by providing a valid resale certificate.

What Is A Tax Exemption Certificate And Does It Expire Quaderno

If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Tennessee sales tax you need the appropriate Tennessee sales tax exemption certificate before you can begin making tax-free purchases.

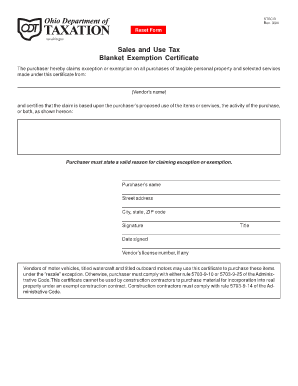

. The Sales Tax Permit allows a business to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell. Prescription Drugs and non-prescription drugs are exempt from the Virginia sales tax. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Ohio sales tax you need the appropriate Ohio sales tax exemption certificate before you can begin making tax-free purchases.

Your misuse of this Certificate with intent to evade the. Companies or individuals who wish to make a qualifying. CST-286 Consumer Sales and Use Tax Special Contractors Exempt Purchases Certificate CST-290 Consumer Sales And Use Tax Certificate Of Capital Improvement Downloadable Data Files Boundary Table A comma-delimited data file which you can save to your computer and then open with the program of your choice.

Ohio tax rules provide some broad categories of purchases that are tax exempt for farmers. Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Maryland Sales Tax Exemption Form to buy these goods tax-free. Tangible personal property refers to propertyexcept land or buildingsthat can be seen weighed measured felt touched or otherwise perceived by the.

The willful issuance of a false or fraudulent Exemption Certificate with the intent to evade Sales or Use Tax is a misdemeanor. Typically tangible personal property used in farming is exempt while real property is not exempt from sales tax. Counties and cities can charge an additional local sales tax of up to 07 for a maximum possible combined sales tax of 6.

It is not intended to answer all questions that may arise. Tax exempt organizations such as nonprofit organizations schools government entities must provide the following items when claiming exemption from sales taxes. 2 Get a resale certificate fast.

The Exemption Certificate Survival Guide has the latest information on resale certificates including multijurisidiction certificates. Exempt verification letter which states the basis of the organizations exemption. Virginia has 1199 special sales tax jurisdictions with local sales.

A text editor or a spreadsheet. When property or services are purchased tax exempt with an Exemption Certificate but later used or consumed in a non exempt manner the purchaser must pay Sales or Use Tax on the purchase price. Companies that qualify for a resale certificate are eligible to purchase items such as ingredients or component parts of the items that they sell.

The processes of obtaining a tax-exempt resale certificate are. Ad 1 Fill out a simple application. The Sales Tax Permit and Resale Certificate are commonly thought of as the same thing but they are actually two separate documents.

November 2021 httpsdorsdgov 1-800-829-9188 Exemption Certificate. A resale certificate cannot be used to purchase items exempt from sales tax that do not qualify for this purpose. Go to the Chrome Web Store and add the signNow extension to your browser.

2 Get a resale certificate fast. Sales Tax Application - Apply for Resale Certificate Resellers Permit Multiple State Application Registrations Reseller License. The answer is simple - use the signNow Chrome extension.

Properly completed and signed exemption certificate. The question arises How can I eSign the ohio resale certificate I received right from my Gmail without any third-party platforms. To the provisions of Title 18 California Code of Regulations Section 1668 Sales and Use Tax Regulation 1668 Resale Certificate.

This page explains how to make tax-free purchases in Ohio and lists three Ohio sales tax exemption forms available for download. Ad 1 Fill out a simple application. The sales tax exemption is only intended to be used for inventory that will be resold and not intended for the tax-free purchase of items used in normal business operations such as paper pens etc.

Certificate The purpose of this Tax Fact is to provide general guidelines and examples of situations that may occur when a business is making exempt sales. Sales and Use Tax Resale Certificate. Multijurisdiction resale certificates or uniform sales tax certificates can be a boon for multi-state companies by eliminating the need to issue dozens of certificates to a single vendor.

By use of this certificate the purchaser certifies that the property is purchased for resale in the regular course of business in the form of tangible personal property which includes property incorporated as an ingredient or component part of an item. This page explains how to make tax-free purchases in Tennessee and lists four Tennessee sales tax exemption forms available for. The information contained in this fact sheet is current as of the date of publication.

More information can be obtained from the individual state tax office website. Below are five simple steps to get your tax exempt form eSigned without leaving your Gmail account. However a business requires a federal Employer Identification Number EIN first before applying for a tax-exempt resale certificate.

A resale certificate and tax exempt certificate are different because of the reasons for the exemptions. A tax-exempt resale certificate can usually be obtained by a business from the state or local tax office. Maryland Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Maryland sales tax only applies to end consumers of the product.

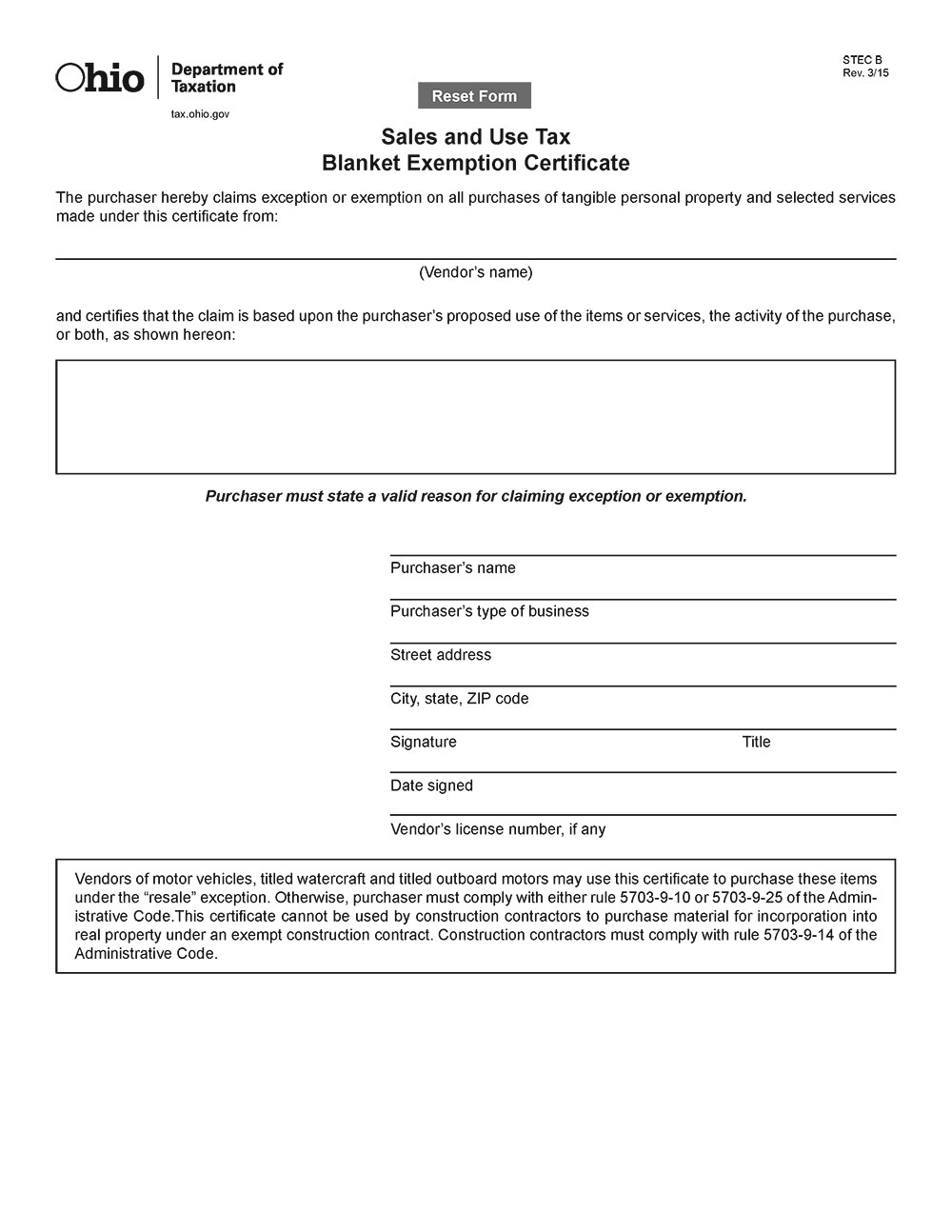

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

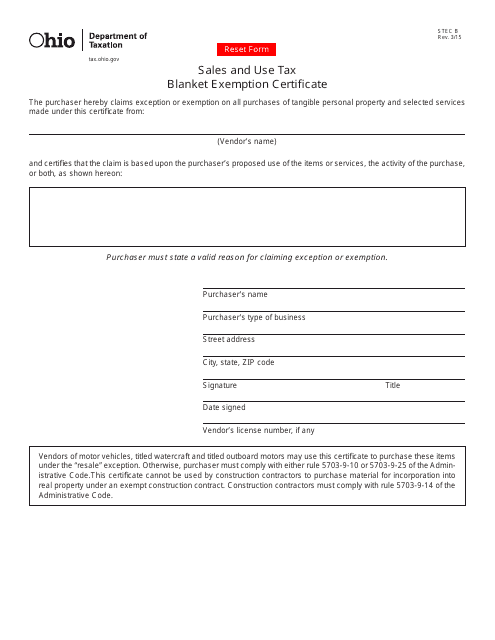

Free Form St 105 General Sales Tax Exemption Certificate Free Legal Forms Laws Com

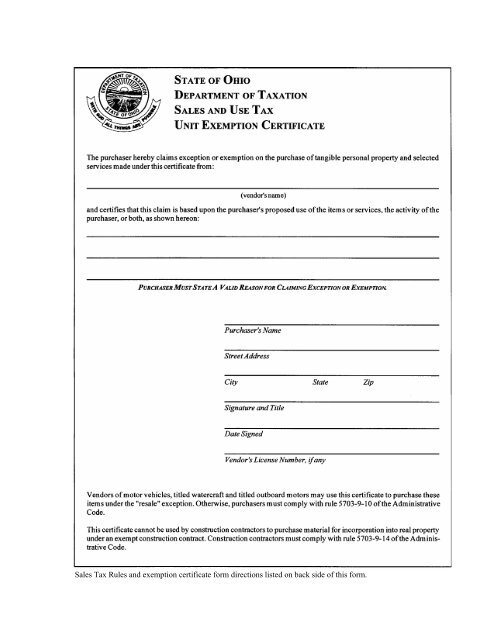

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

Ohio Tax Exempt Form Holland Computers Inc

Mock Certificate Template 6 Templates Example Templates Example Certificate Templates Free Certificate Templates Graduation Certificate Template

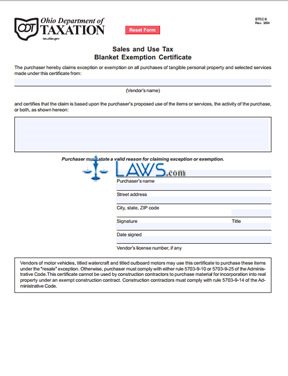

Free Form Sales And Use Tax Blanket Exemption Certificate Free Legal Forms Laws Com

Sales Tax Exemption For Building Materials Used In State Construction Projects

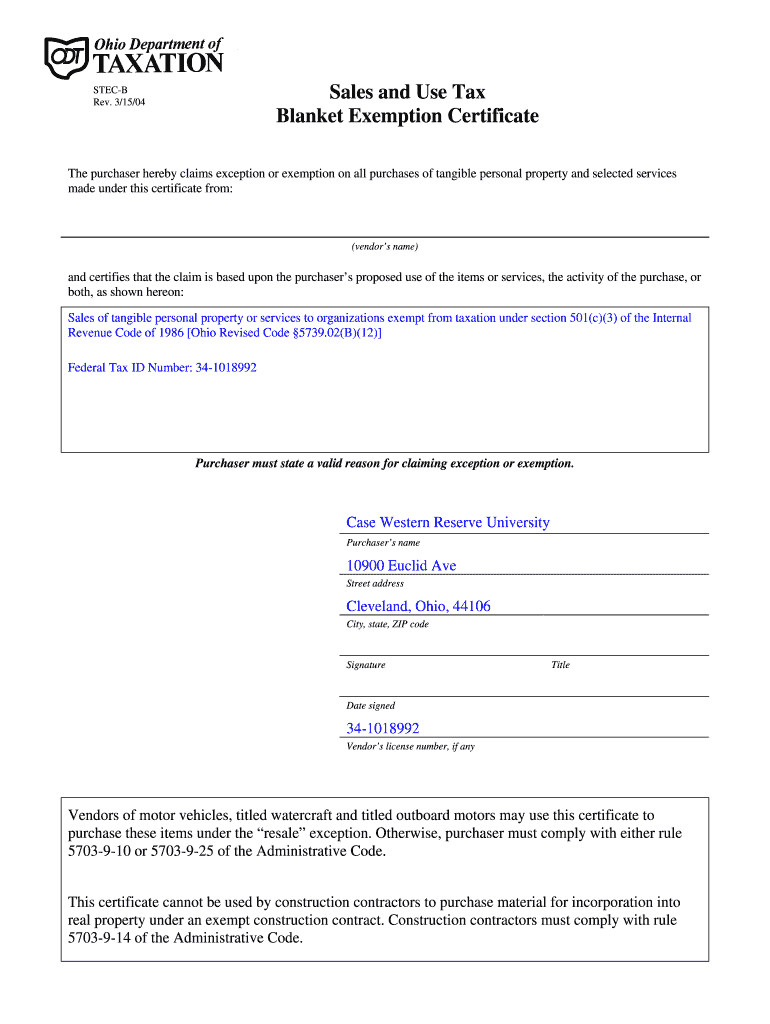

Case Western Tax Exempt Certificate Fill Online Printable Fillable Blank Pdffiller

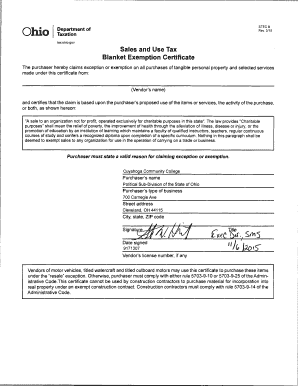

Ohio Farming Blanket Exapmtion Certificate Fill Online Printable Fillable Blank Pdffiller

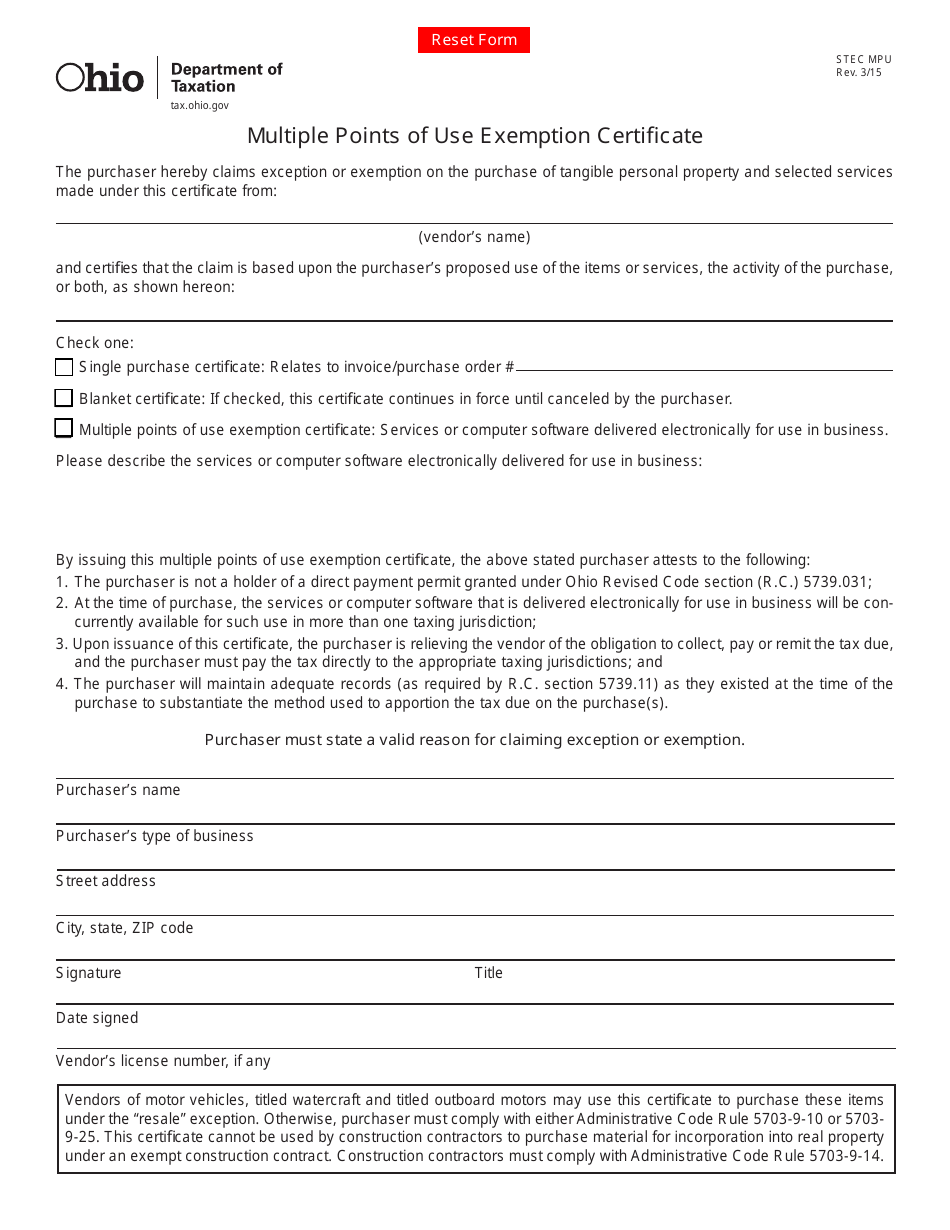

Form Stec Mpu Download Fillable Pdf Or Fill Online Multiple Points Of Use Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form For Farmers Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Ohio Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

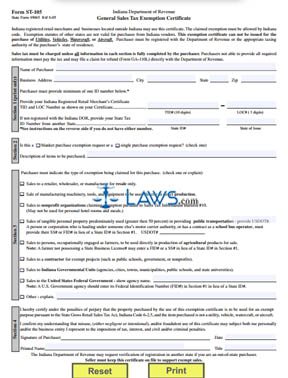

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller