capital gains tax increase date

Were going to get rid of the loopholes that allow Americans who make more. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners.

Rsus Restricted Stock Units Essential Facts Capital Gains Tax Key Dates How To Apply

Some interesting Canadian media commentary about the federal budget and what might be coming can be accessed here.

. The effective date for this increase would be September 13 2021. Long-Term Capital Gains Taxes. The Canadian federal budget has a release date.

That applies to both long- and short-term capital gains. From a tax perspective heres a short list of things that our firm will be looking for. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The 1987 capital gains tax collections were slightly below 1985. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

Understanding Capital Gains and the Biden Tax Plan. There is currently a bill that if passed would increase the. If we conservatively use October 15 2021 as the effective date of the tax rate increase any tax-advantaged MSR trade would need to have a sale date of 9302021.

Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall. You report capital gains and capital losses in your income tax return and pay tax on your capital gains. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25.

It is not a separate tax. State and local taxes often apply to capital gains. The rates do not stop there.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. When including the net investment income tax the top federal rate on capital gains would be 434 percentRates would be even higher in many US. When the additional tax on NII is factored in investors earning 1 million or more could actually see their tax rate on capital gains jump to.

Implications for business owners. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. The proposed capital gains tax reforms of which any Budget.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Keep in mind however that the President still needs Congress to agree to this retroactivity and Democrats. The maximum rate on long-term capital gains was again.

In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0.

In fact recent intelligence suggests many Democrats favor a rate increase as low as 42 percentage points which would result in a 242 rate before net investment income NII tax and a 28 rate inclusive of the 38 NII tax. It was announced today that the budget will be released on the afternoon of April 7 2022. Thus for households earning more than 1 million the capital gains tax rate would increase from 238 to 434 as of April 28 2021 thus eliminating the opportunity to recognize gain at current rates in advance of the legislation.

Hawaiis capital gains tax rate is 725. Ad If youre one of the millions of Americans who invested in stocks. Youll owe either 0 15 or 20.

Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic. It would be very surprising to see the capital gains rate go higher than 28. Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married filing jointly with income over 496601.

Some states structure their taxes differently. This resulted in a 60 increase in the capital gains tax collected in 1986. The current estimate of that effective date ranges from October 15 2021 on the early.

If you have a 500000 portfolio get this must-read guide by Fisher Investments. Ad Read this guide to learn ways to avoid running out of money in retirement. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Therefore the top federal tax rate on long-term capital gains is 238. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Although it is referred to as capital gains tax it is part of your income tax.

Additionally a section 1250 gain the portion of a. If you have a capital gain it will. Capital gains tax rates on most assets held for a year or less correspond to.

This resulted in a 60 increase in the capital gains tax collected in 1986. Once fully implemented this would mean an effective federal. The Chancellor will announce the next Budget on 3 March 2021.

Additionally the change to 25 could be effective.

Each Asset Class Is Tax Differently Use This To Your Advantage In Planning For Retirement Capital Gains Tax How To Plan Retirement Planning

Taxation In Australia Wikipedia Capital Gains Tax Income Tax Return Payroll Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

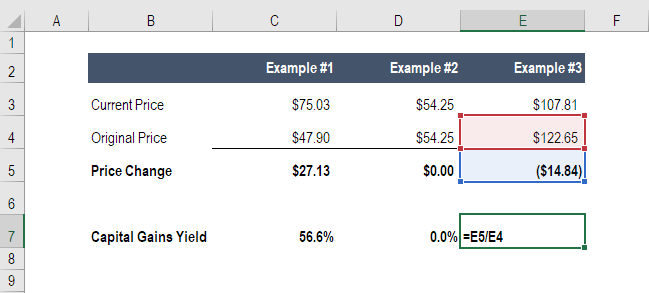

Capital Gains Yield Cgy Formula Calculation Example And Guide

As Per The New Ltcg Long Term Capital Gains Tax Law A 10 Charge Will Be Imposed Starting From Financial Year Capital Gains Tax Capital Gain Equity Capital

Harpta Maui Real Estate Real Estate Marketing Maui

Capital Gains Tax What Is It When Do You Pay It

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

Reap The Benefits Of Tax Loss Harvesting To Lower Your Tax Bill Investing Income Tax Preparation Capital Gains Tax

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

Pin By Dua Financial Fmp Bonds Els On Dua Capital Tax Free Investments Taxact Investing

Accounting Taxation Income Tax Audit Requirements Interest Rates Penalty Appel Fees Deductions Capital Gain Rates And Exemption Income Tax Tax Income

Capital Gains Tax What Is It When Do You Pay It

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Gold Investment Made Easy Findoc Group Investing Gold Investments Make It Simple

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)